Cyprus residency by investment

Updated: January 14, 2026

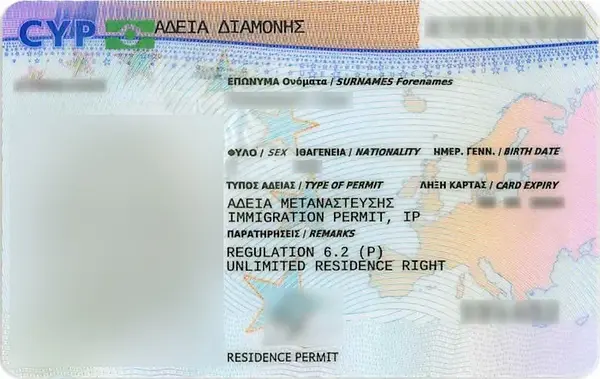

The Cyprus Residency by Investment scheme allows qualifying investors and their families to secure a long-term immigration permit in as little as six months. Once granted, holders of this permit may become eligible to apply for Cypriot citizenship after eight years of living in the country.

Starting in 2026, permanent residence can be obtained by investing a minimum of €300,000 in property, company shares, or investment funds, along with proving an annual income of at least €50,000. For residential property purchases, the required income must come entirely from abroad, whereas other investment categories allow part of the income to be earned in Cyprus.

The investor visa framework was revised on May 2, 2023. The amendments raised the minimum required annual income from €30,000 to €50,000, removed the applicant’s parents and in-laws from the list of eligible dependants, and introduced several other adjustments. All current requirements of the updated program are outlined below.

________________________________________

🏡Cyprus residency by investment requirements in 2026

In 2026, applicants must commit a minimum of €300,000 to one of several approved investment routes — such as purchasing newly built residential property, acquiring commercial real estate, or buying shares in a Cyprus-based company. Applicants must also demonstrate an annual income of at least €50,000, with additional income required for family members (€15,000 for a spouse and €10,000 for each dependent child). The acceptable income sources depend on the chosen investment option.

The approved investment categories include:

1. Purchase of new residential property

Applicants may buy a newly constructed house or apartment with a minimum value of €300,000 plus VAT. Two separate units from different developers can also be purchased, provided the combined value meets the required threshold. Off-plan properties qualify as well, regardless of completion dates. When a couple buys jointly, the same minimum investment requirement applies to the total purchase.

2. Acquisition of commercial real estate

This may include offices, retail premises, hotels, mixed-use developments, or a combination of these asset types. Both new and resale properties are acceptable under this category.

3. Investment in the share capital of a Cyprus company

Applicants may establish or invest in a Cyprus-registered company, provided the business operates within the Republic, maintains a physical presence, and employs at least five staff members.

4. Investment in units of the Cyprus Investment Organisation of Collective Investments

This includes purchasing units in registered structures such as AIFs, AIFLNPs, or RAIFs.

We typically advise clients to consider real estate options, as they tend to offer a more stable and secure route to securing Cyprus residency.

________________________________________

📊 Income requirement

Applicants must demonstrate a minimum annual income of €50,000 after tax. This threshold increases by an additional €15,000 for a spouse and €10,000 for each minor child. If the spouse earns income, it may be included when calculating the total eligible amount.

Acceptable income sources may include:

-

employment or wage-based earnings

-

pensions, dividends, fixed-term deposit returns, and rental income

For those choosing the residential property investment route, the entire income must originate outside Cyprus.

For all other qualifying investment paths — such as commercial property, company share capital, or investment fund units — income may come from Cypriot sources, provided it is taxed within the Republic.

🛠️ Annual obligations to verify criteria

Holders of Cyprus residency by investment must comply with ongoing verification procedures to keep their status valid.

Each year, applicants are required to provide:

-

Proof that the qualifying investment is still in place, and

-

A valid health insurance policy for themselves and their family members (unless they are covered under GESY).

Every three years, the following must be submitted:

-

Updated criminal record certificates for the applicant and all family members, issued both by the country of origin and the country of residence.

The previous requirement to submit annual proof of income has been removed.

However, applicants must avoid the following, as these can lead to the cancellation of the permit:

-

Obtaining permanent residency in another country, or

-

Being absent from Cyprus for a continuous period of two years.

Failure to provide the required documentation or to meet these conditions may result in the withdrawal of the residence permit.

________________________________________

👥 Dependent persons

Permanent residence applications can include the following family members:

-

Spouse and children under 18 years of age

-

Children aged 18 to 25 who are unmarried and enrolled in a university program.

Children planning to study at a Cypriot university must first obtain a student visa. Upon completion of their studies, they may apply for an Immigration Permit, which will remain valid even after they turn 25. For each such child, parents must demonstrate an additional annual income of €10,000.

If the purchased residential property does not have enough bedrooms to accommodate dependent family members, the applicant must provide evidence of an alternative residence for them, such as a title deed, sale agreement, or rental contract.

👤 Higher investment for adult children

“Adult children” refers to the applicant’s children who are financially independent.

To include an adult child under the same residency application, the applicant must meet an increased investment threshold. Specifically, the standard €300,000 investment must be multiplied by the number of adult children included.

Example calculations:

-

One adult child: minimum investment of €600,000

-

Two adult children: minimum investment of €900,000

For real estate-based applications, a payment certificate confirming at least 66% of the property’s market value must be submitted along with the application.

Additionally, each adult child must show a minimum annual income of €50,000. This requirement increases if the adult child has dependents — by €15,000 for a spouse and €10,000 for each child.

🆔 Can I buy property in Cyprus and obtain citizenship?

There is no fast-track route to Cypriot citizenship. By purchasing property valued at €300,000 or more, you can secure permanent residency in Cyprus. Citizenship may then be applied for through naturalisation after eight years of actual residence, which requires a total of 2,555 days in Cyprus plus 12 consecutive months with absences not exceeding 90 days prior to the application.

It’s important to note that the previous 5-year citizenship option for investment residency holders is no longer available in 2026. The eight years of residence must fall within the 10-year period immediately preceding your application. For more details, see the guidelines on Cyprus citizenship by naturalisation.

________________________________________

🔝 Benefits of investment PR

Obtaining permanent residency in Cyprus offers several advantages:

-

Freedom to live and travel within Cyprus without restrictions

-

Attractive tax regime, including one of the lowest corporate tax rates in Europe at 12.5%

-

Eligibility for including the applicant’s spouse and minor children in the application

-

Access to healthcare through the General Healthcare System (GESY)

-

No requirement for continuous residence — a short visit to Cyprus every two years is sufficient to maintain residency

🌍 Schengen Area and Europe visa-free travel

Holding a Cyprus residence permit does not provide visa-free access to the Schengen Area or other EU countries, since Cyprus is not part of the Schengen zone as of January 2026. Cyprus has submitted an application to join Schengen, which is currently under review.

ℹ️ Additional Information

Holders of a Cyprus permanent residence permit must personally visit Cyprus at least once every two years.

Applicants are not permitted to engage in paid employment within Cyprus, except they may serve as directors in a company in which they have invested under this program. They can also hold shares in Cyprus-registered companies and receive dividends, and act as directors without receiving a salary.

All investment funds must originate from abroad and be transferred directly to Cyprus.

-

The typical processing time for an application is around six months.

-

The application fee is €500, plus €70 for each accompanying family member.

-

The final decision rests with the Minister of the Interior.

📁 Required Documents

To apply for a Cyprus investment visa, the following documents are needed:

-

Completed Application Form MIP2

-

Passport copies of the applicant(s)

-

CVs for the applicant(s)

-

Marriage certificate (official with certified translation*)

-

Children’s birth certificates (official with certified translation*)

-

Criminal record certificates from the country of residence (official with certified translation*)

-

Statement confirming that neither the applicant nor spouse will engage in paid employment in Cyprus

-

Tax statements or confirmation from a qualified auditor in the applicant’s tax-resident country to verify income; original documents must be accompanied by a sworn affidavit

-

Acceptable income includes salaries, pensions, dividends, fixed deposits, and rents; the spouse’s income may also be included

-

-

Proof that investment funds were transferred from abroad (e.g., bank transfer evidence)

-

Health insurance certificate covering the applicant and spouse/underage children

-

Authorisation for a representative, signed and certified

-

For children aged 18–25, a university confirmation and additional documentation are required (details available at mip.gov.cy)

*Documents marked with an asterisk must be translated into English and either bear an APOSTILLE stamp or be certified by the Ministry of Foreign Affairs of the issuing country and the Cyprus Embassy.

🗃️ Investment-Related Documents

The documents required depend on the chosen investment route:

-

Residential or commercial property: Contract of sale and proof of payment of at least €300,000

-

Cyprus company share capital: Share Purchase Agreement, Certificate of Shareholders and Incorporation, business profile, and social insurance documents confirming employed personnel

-

Units in Cyprus Investment Organisations (AIF, AIFLNP, RAIF): Proof of unit purchase, CySec confirmation, and fund memorandum or investment plan